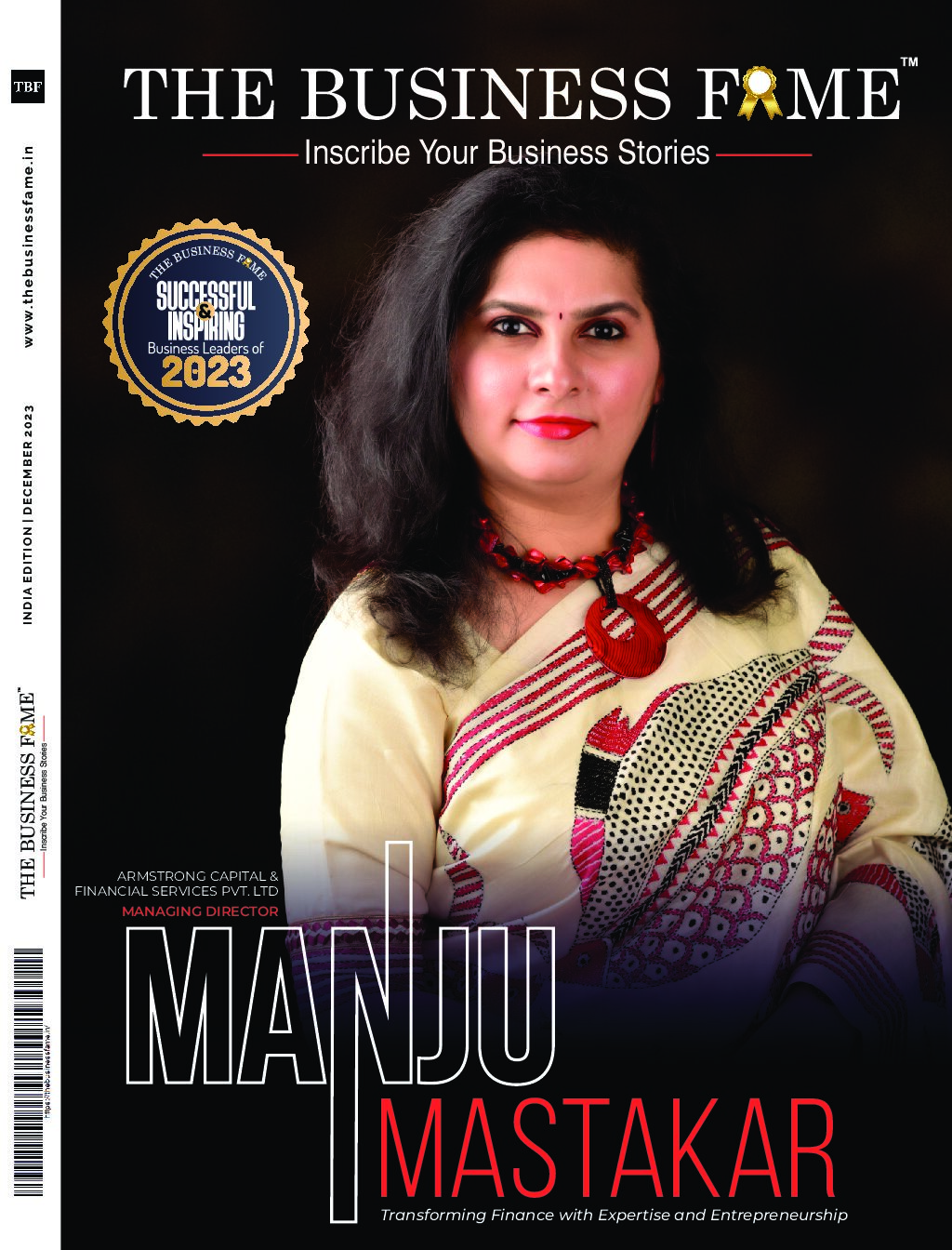

Manju Mastakar, the Founder and CEO of Armstrong Capital & Financial Services Pvt. Ltd., is a seasoned finance professional with over two decades of experience in managing investments. Her journey began on Dalal Street in Mumbai, advising direct equity traders, and has traversed through corporate giants like Motilal Oswal, MF Global, and HSBC before she founded Armstrong Capital in 2010.

Manju started her career as an intern with a CA firm in 1997, handling tax returns for clients engaged in substantial stock trading. Early on, she gained insights into the intricacies of trading and investing through hands-on experience in auditing stock broking firms and bank branches. Her career evolved through various roles in broking firms, banks, and wealth management, progressing from a dealer to a regional manager. With a wealth of experience advising over 1000 clients with diverse profiles, geographies, and mindsets, Manju accumulated a deep understanding of the financial landscape.

The entrepreneurial chapter of her career began in 2009 during the subprime crisis, leading to a layoff. Seizing the opportunity to fill the advisory gap left for her clients, she started freelancing from a home office, managing both motherhood and entrepreneurship simultaneously. In 2010, with funding from an investment banker, she transitioned into a more professional setup, expanding operations from a co-working space.

The initial years were marked by struggles and multitasking, evolving from a solo operation to a comprehensive financial advisory firm. Starting with direct equity advisory, services expanded to include currency and commodity derivatives. By 2014, the organization incorporated mutual funds, insurance, fixed income instruments, PMS, and AIF, experiencing rapid growth.

Manju’s leadership is characterized by resilience, adaptability, and a commitment to delivering comprehensive financial solutions. She designed and developed key offerings, creating a culture of excellence at Armstrong Capital & Financial Services Pvt. Ltd. The company’s approach involves in-depth research to support recommendations, innovative portfolio evaluation, and a steadfast commitment to building trust—a cornerstone of their business. Manju’s entrepreneurial journey reflects her dedication to transforming the financial landscape through expertise and innovation.

Tailored Excellence

Armstrong Capital & Financial Services Pvt. Ltd. stands as an investment solution firm, offering a comprehensive range of wealth management services to its clients. The firm prides itself on being dynamic and innovative, dedicated to delivering tailored and holistic financial solutions.

Recognizing the uniqueness of each client’s financial needs and objectives, the firm adopts a customized approach to financial planning. Taking the time to thoroughly understand individual circumstances, the team at Armstrong Capital & Financial Services works on developing personalized solutions aligned with specific goals. Whether the objective is wealth building, retirement planning, asset protection, or tax liability minimization, the firm collaborates closely with clients to formulate strategies that suit their needs.

The firm manages a versatile portfolio covering a broad spectrum of financial services, including curated portfolios, mutual funds, international funds, passive indexes, Portfolio Management Services (PMS), Alternative Investment Funds (AIF), Real Estate Investment Trusts (REITS), structured products, risk management, corporate bonds, and fixed-income instruments.

A commitment to transparency and communication underpins Armstrong Capital & Financial Services’ client relationships. The firm believes that open and honest communication is essential for building strong and lasting connections with clients. The team is dedicated to providing clear, concise, and transparent advice, taking the time to demystify complex financial concepts and ensure understanding among its clients.

The interview highlights key aspects of Manju Mastakar’s outstanding leadership in the financial landscape, illustrating her visionary approach and empathetic stance toward emerging finace leaders:

Can you share the pivotal moments or inspirations that led you to venture into the dynamic world of financial markets?

Hailing from Mumbai, the financial capital of India, added a unique dimension to my journey. Starting my career on the iconic Dalal Street, the heartbeat of the Indian financial markets, was both a privilege and a defining experience. The hustle and bustle of Dalal Street became the backdrop of my formative years, shaping not just my professional acumen but instilling a deep-rooted connection to the financial world. As I pursued my passion for financial markets, Dalal Street became both a starting point and a symbol of resilience. It serves as a constant reminder that, while I may have ventured beyond its physical boundaries, the spirit and tenacity of Dalal Street continue to drive my aspirations and achievements in the financial world.

What inspired your decision to enter an industry traditionally dominated by men and succeed in establishing a significant presence?

Jeff Bezos once said that you don’t choose your passions, but your passions choose you. The inspiration to enter an industry traditionally dominated by men stemmed from a deep-rooted passion of following stocks and doing financial statement analysis, a passion that seemed to choose me rather than the other way around.

Back in my college days, I immersed myself in reading about financial markets, corporate success stories, and meticulously tracking stock prices. My fascination with understanding businesses, their profitability, and the intricate details of market performance led me to create a dashboard where I could analyze stock prices alongside various factors such as earnings, mergers, and acquisitions.

I’ve always believed that women often gravitate towards endeavors they feel comfortable with and have a passion for. While men might venture into the unknown, taking risk, tackling new challenges and industries, women tend to build on their existing knowledge and skills. In my case, the stock market was not just a career choice; it was a calling driven by passion, familiarity, and hands-on experience.

It’s not just about entering an industry; it’s about embracing the challenge, defying stereotypes, and making a mark where passion meets expertise. Aspiring women should recognize their capabilities, step into uncharted territories, and let their passion guide them to success, just as it did for me in the world of finance.

How is your approach evolving the industry needs?

Embarking on our business journey in 1997, our early days were characterized by a hands-on, personal approach. Face-to-face interactions and physical paperwork were the norm as we built connections with clients. However, as the business landscape evolved, so did our methods of engagement.

The advent of technology played a pivotal role in reshaping our approach. We seamlessly transitioned from phone calls to virtual meetings through platforms like Google Meet and Zoom. Today, our onboarding processes involve sophisticated presentations, adapting to the demand for more structured and streamlined interactions. We take pride in fostering strong relationships with clients we may have never met in person, underscoring the effectiveness of our evolved communication methods. This transformation wasn’t just about adopting technology; it was about leveraging it to enhance the overall client experience.

What are the most significant challenges currently faced by your industry?

Our foremost challenge emerges from the deluge of investment advice flooding platforms like YouTube. In this era of social media and financial news channels, individuals often find themselves bombarded with generic investment recommendations that fail to consider their unique financial circumstances. The fact that advice given to a 20-year-old is the same as that given to a 30-year-old or even a 60-year-old, oversight neglects critical factors such as risk appetite, age, and individual financial goals.

Our significant challenge lies in bridging the gap of understanding among investors. Many follow the advice of YouTube finance influencers who provide recommendations on specific stocks or mutual funds without emphasizing the equally crucial aspects of exit strategies. It’s not just about what to buy; it’s about knowing when to exit an investment. These influencers may offer insights into attractive investment opportunities, but they often fall short in guiding investors on strategic exits or recognizing underperformance that necessitates a shift to another fund.

Our commitment is not only to provide guidance on entry points but to equip individuals with the knowledge, a comprehensive understanding and strategic insight needed to navigate the entire investment journey successfully.

As a leader, can you share a challenging moment you’ve faced, especially in the context a startup environment?

In the startup world, it’s not uncommon for leaders to secure funding, rapidly expand their teams, and then find themselves facing a funding winter.

One particular incident stands out when an employee asked me about the company’s financial health. We were in a situation where the markets weren’t performing well, brokerages were down, and client conversions were lagging. The challenge was to manage this pressure while maintaining a positive and reassuring demeanor for my team. Employees can read into the leader’s expressions, and it’s crucial not to convey a sense of financial strain that might lead them to explore other opportunities.

The most difficult part was to compartmentalize the pressure and present a composed front to the team. It’s about striking a balance between the aggressive pursuits of growth and providing the necessary comfort to the employees.

Being able to remain composed, digest the challenges, and convey a sense of security to the team is paramount. It’s about instilling trust – the belief that, just like passengers trust a pilot during a flight, the team trusts the leader to navigate the organization through challenges. This trust is what sets apart an entrepreneurial leader, assuring the team that, regardless of the hurdles, the leader is equipped to steer the organization successfully.

Employee attrition is a significant challenge in the BFSI sector, particularly in roles such as wealth management. What, in your experience, sets Armstrong apart in terms of employee retention?

Indeed, employee attrition is a common concern in our industry, and at Armstrong, we’ve taken a distinctive approach to address this challenge. What sets us apart is our commitment to nurturing talent and creating a culture that fosters both personal and professional growth.

In our industry, there’s a unique hurdle related to the design of financial products, where remuneration tends to be lower in the initial years, and it takes a considerable time—around 36 to 40 months—for a resource to become profitable. Many organizations, driven by the need for quick results, set high sales targets with front-loaded remuneration. This, unfortunately, contributes to the industry’s high attrition rates.

At Armstrong, we’ve embraced a different model. We invest substantial time upfront to understand a candidate’s motivation and passion for the wealth management profession. Our interview process is rigorous, focusing not only on skills but also on talent and genuine interest. Once a candidate is on board, we prioritize extensive training—spanning nine to twelve months—providing practical experiences in wealth management.

We deliberately set realistic expectations for the initial period, acknowledging that our efforts will yield long-term rewards. This approach allows our team members, or “green shoots” as we call them, the space to grow and contribute meaningfully to the organization. The culture at Armstrong emphasizes personal growth, job security, and a sense of belonging.

Our team members are not just employees; they are contributors to our journey. We encourage a culture where ideas are heard, implemented, and credited back to the contributors. This sense of ownership and the realization that their contributions make a difference are fundamental to building employee confidence and loyalty.